Legacy

Planning vs Estate Planning: What's the Difference?

- Home

- LEGACY PLANNING VS. ESTATE PLANNING

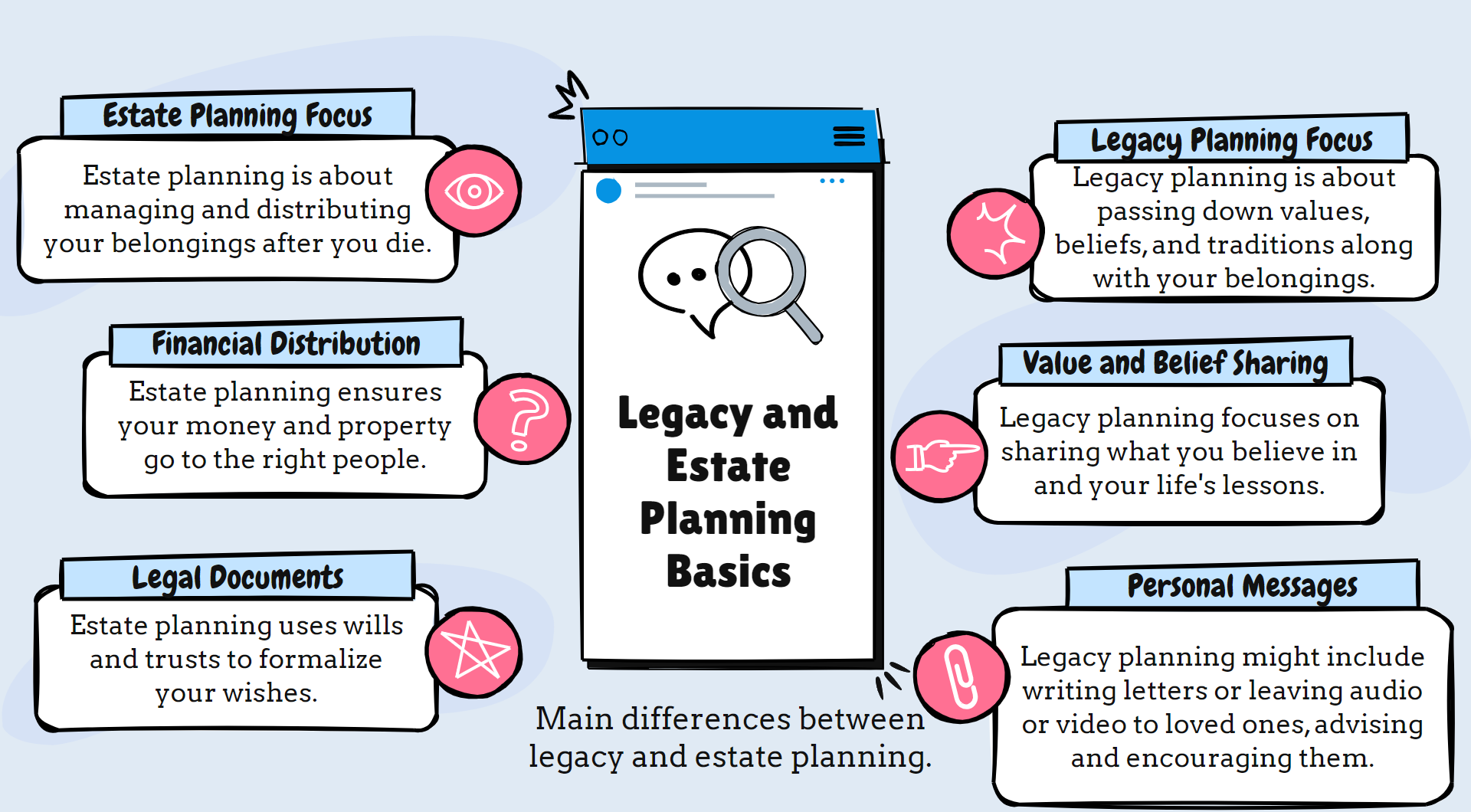

When you think about the future and what happens after you’re gone, you might hear the terms legacy planning vs estate planning. These two ideas might sound the same, but they are actually different. This guide will help you understand legacy planning vs estate planning so you can make the right choices.

First, let's see what these terms mean. Estate planning is about setting up how your things, like your money and property, will be managed and given out after you die.

It includes making a will, picking an executor and choosing who gets what. The main goal is to make sure your wishes are followed and your family is cared for financially.

Legacy planning is bigger than just money and legal stuff. It covers how you want to be remembered, what values and life lessons you want to share, and how you hope to affect future generations. It’s about your overall impact on others.

For instance, in legacy planning, you might write down your life lessons and values for your family. You could have special talks with loved ones to share advice. Or you might start a charity or scholarship to help others after you’re gone. These activities aren't usually part of just estate planning.

Estate planning generally focuses on what happens after you die, though you can update your plans while you're alive. But with legacy planning, you can work on it and see its effects while you’re still here.

Building relationships, sharing what you know, and making a positive difference are all parts of legacy planning. You don’t have to wait until you’re gone to start creating your legacy. In fact, working on it now sets it apart from traditional estate planning.

Legacy planning is more about personal reflection. It involves thinking deeply about your life, what matters to you, and how you want to be remembered.

Estate planning, while personal because you decide who gets your things, is more about legal steps like filling out forms and naming who gets your money. It’s about making sure your assets move smoothly, not necessarily about deeper emotional meanings.

Legacy Planning vs Estate Planning

Without estate planning, realizing your legacy ideas could be tough. Disputes about assets and unclear wishes can overshadow the values and messages you want to leave.

Legacy planning adds meaning and purpose to your estate planning. By knowing your values and dreams, you can make estate planning choices more thoughtfully. Your legacy becomes the guide for how you set up your estate.

For example, if education is important to you, that might encourage you to include educational trusts or donations in your estate plan. If family unity matters, it might guide how you plan who gets what and how you talk about it with your family.

Overall, while both estate planning and legacy planning have their unique parts, they work best together. Estate planning sets a practical base, and legacy planning provides the vision. Together, they help you shape your impact on the world.

To start with legacy planning and estate planning, reflect on what's important to you. Think about your values, life experiences, and dreams. Ask yourself what guidance you want to share and how you want to be remembered. You might find it helpful to write down your thoughts, talk with loved ones, or consult a legacy planning expert.

For estate planning, organize your assets and decide how you want them shared. Consider working with a lawyer or financial expert to create legal documents like a will. Discuss your plans with your family to ensure everyone understands.

Remember, both legacy and estate planning are ongoing. As life changes, like marriage, kids, or financial shifts, update your plans to keep them relevant.

Sharing your stories can be a powerful part of bringing your legacy to life. Writing down or telling important memories and lessons can pass on your wisdom and add a personal touch to your estate plans.

Samantha, a successful entrepreneur, spent years building her business and wealth. As she moved into her later years, she knew she wanted to leave a positive legacy. She started by getting her estate plans in order - creating a will, picking an executor, setting up trusts for her children and charities, and ensuring her assets would be managed wisely.

But Samantha didn't stop there. She also spent time reflecting on the values and life lessons she wanted to pass on. She wrote heartfelt letters to each of her children and grandchildren, sharing her love, her proudest moments, and her hopes for their futures. She also set up a donor-advised fund focused on causes close to her heart, which her family could continue contributing to in her memory.

When Samantha passed, her loved ones grieved deeply. But they also felt immense gratitude and inspiration. Not only were they taken care of financially, but they had a clear sense of Samantha's love and life purpose. Her legacy lived on through the stories, values, and generosity she had intentionally planned and shared. The estate plans and legacy plans wove together beautifully to create an enduring imprint.

Samantha's story illustrates how powerful it can be to approach legacy planning and estate planning in tandem. By taking care of the practical matters and infusing them with deeper meaning and intention, you can create a legacy that touches both the head and the heart.

- Home

- LEGACY PLANNING VS. ESTATE PLANNING