- Home

- Settle an Estate

How to Settle an Estate - 3 Goals

If you want learn how to settle an estate with the least amount of stress and family conflict. There are only 3 goals you want to achieve.

1. File the right kind of tax return.

When someone dies, two taxpayers are created.

First, the income they earned from January 1 of the year of death to the date of death is reported on what is known as the terminal return.

Second, the date after death is the first date for the new taxpayer, which is the estate.

As an executor in Canada, you are responsible for filing T1 personal tax returns on behalf of the deceased, including the terminal tax return.

If the deceased had not filed their tax return for the prior year before their death, you may also have to file a T1 return.

If the tax returns are filed incorrectly, costly government fines could be assessed, money wasted, and family discord fueled.

It’s important to remember that taxes might need to be filed for two years, not one.

To settle an estate in the United States: to officially close an estate, you’ll need to work with a probate court to finalize the process.

How to settle an estate after a loved one passes away

2. Distribute to the beneficiaries

As a general rule of thumb, you as the executor to settle an estate you should work toward wrapping up the estate within one year of the testator’s death.

You could be penalized, personally, if you take too long to get everything completed.

As executor, you assume a certain degree of personal liability when taking on the role. This has to be understood by the beneficiaries. This is where open communication is very important.

Be up front with what is happening with the estate and how it is progressing.

Leaving them out of the process can lead to needless tension, conflict, and sometimes legal action.

3. Close the Estate

Before distributing all of the estate, as executor you should obtain a clearance certificate from the Canada Revenue Agency (CRA). Getting a clearance certificate provides protection for the executor—it does not prevent the CRA from going back to the beneficiaries to get any additional tax that may be owed.

However, if you are the executor and the beneficiary, getting a clearance certificate may not be required.

But when there is more than one executor and beneficiary, a clearance certificate should be obtained.

The final responsibility of the executor is the same in the United States—to officially close the estate.

This can only be done once all of the beneficiaries have received their legal property, and once taxes and other debts have been paid.

In order to officially close an estate in the United States, you’ll need to work with a probate court to finalize the process.

If you distribute all of the estate before receiving government clearance, you can be held personally liable for any additional taxes assessed against the estate.

Resolving Disputes and Family Conflict

Sarah, a widow, passed away without leaving a clear and updated will.

Her two adult children, Mark and Lisa, had different interpretations of their mother's verbal wishes regarding asset distribution.

This disagreement created tension and led to a legal dispute during estate settlement. The court appointed a mediator to help resolve the conflict, ensuring fair distribution based on legal guidelines.

With patience, open communication, and professional guidance, Mark and Lisa reached a settlement agreement.

Eventually, the estate was settled, and the siblings were able to reconcile their differences, preserving their relationship despite the challenging circumstances.

7 FAQs About How to Settle an Estate

What is estate settlement, and why is it necessary?

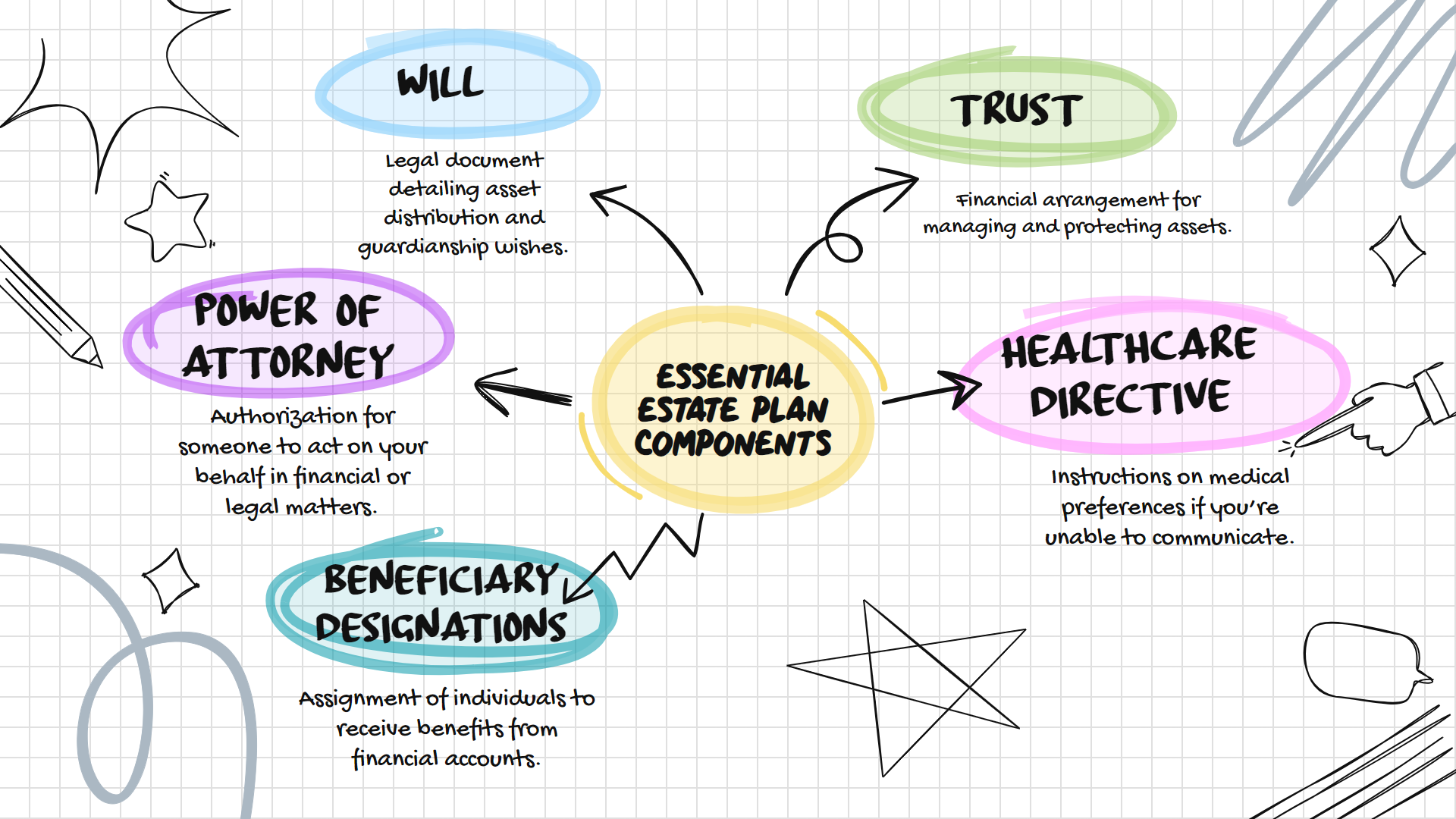

Estate settlement refers to the legal and financial process of managing a deceased person's assets, debts, and final affairs. It ensures that the deceased's wishes are carried out and that assets are distributed appropriately.

Who is responsible for settling an estate?

Typically, an executor or personal representative is appointed in the deceased's will or by a court. This person is responsible for overseeing the estate settlement process, including managing assets, paying debts, and distributing inheritances.

How long does the estate settlement process take?

The duration of estate settlement can vary depending on factors such as the complexity of the estate, the presence of disputes, and local laws. It can range from a few months to several years.

What documents are necessary for estate settlement?

Important documents include the deceased's will, trust agreements, financial statements, property deeds, insurance policies, and any other relevant legal or financial records. These documents provide crucial information for asset distribution and debt settlement.

How are debts and taxes handled during estate settlement?

The executor is responsible for identifying and paying off the deceased's outstanding debts and taxes using the estate's assets. This process involves notifying creditors, gathering necessary documentation, and ensuring accurate record-keeping.

How are assets distributed to beneficiaries?

Asset distribution depends on the instructions left by the deceased in their will or trust. The executor must identify and value assets, resolve any disputes, and ensure the fair distribution of assets to the designated beneficiaries.

Do I need legal assistance to settle an estate?

While it's not always required, seeking legal assistance from an attorney experienced in estate planning and probate can be highly beneficial. They can provide guidance, ensure compliance with laws and regulations, and help navigate complex situations that may arise during estate settlement.

- Home

- Settle an Estate